Loyalties Menu - Payout Loyalties (v2.8)

This option only applies to loyalties that are redeemed by customers as direct payments, e.g. by cash, cheque, direct deposit or gift voucher.

You can payout loyalty credits to customers at any time. When you run this process, the loyalty credits are paid out of your company's bank account.

You need to create a separate loyalties batch for each payment type, e.g. cash, cheque, direct deposit or gift voucher.

To payout loyalty credits to customers:

- Select DEBTORS | DEBTORS TRANSACTION PROCESSING | LOYALTIES MENU | PAYOUT LOYALTIES and either:

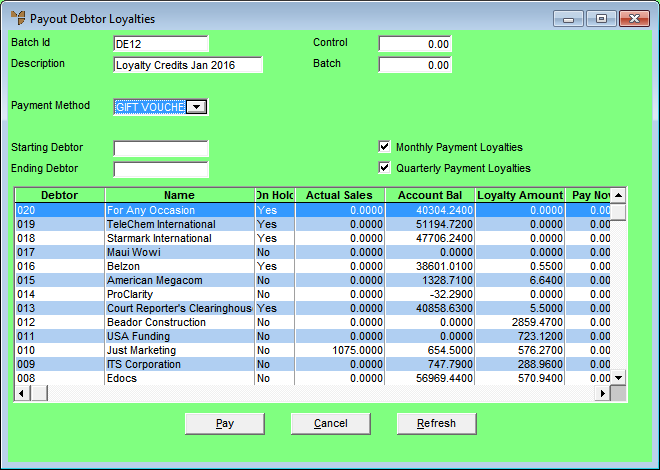

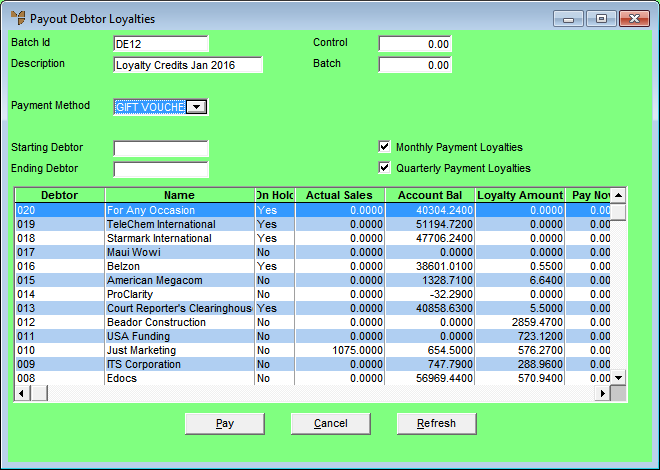

Micronet displays the Payout Debtor Loyalties screen.

- Complete the following fields:

|

|

Field

|

Value

|

|

|

Batch Id

|

Micronet displays the batch ID you entered on the Add New Debtors Batch screen.

|

|

|

Description

|

Micronet displays the batch description you entered on the Add New Debtors Batch screen.

|

|

|

Control

|

This field is not used for loyalties batches.

|

|

|

Batch

|

Micronet displays the total of all loyalty credits to be paid out in the Pay Now column.

|

|

|

Payment Method

|

Select the method by which customers in this batch will be paid their loyalty credits.

|

|

|

Starting / Ending Debtor

|

To payout loyalty credits for specific debtors, enter the IDs of the starting and ending debtors. Leave these fields blank to include all applicable debtors.

|

|

|

Monthly Payment Loyalties

|

Check this box if you want to payout loyalty credits which are accrued as monthly payments to customer accounts.

|

|

|

Quarterly Payment Loyalties

|

Check this box if you want to payout loyalty credits which are accrued as quarterly payments to customer accounts.

|

- Select the Refresh button.

Micronet displays all debtors matching your selections, along with their accrued loyalty credits in the Loyalty Amount field.

- To edit the loyalty credits to be paid out for a specific customer, double click on that customer or select the customer then press Enter.

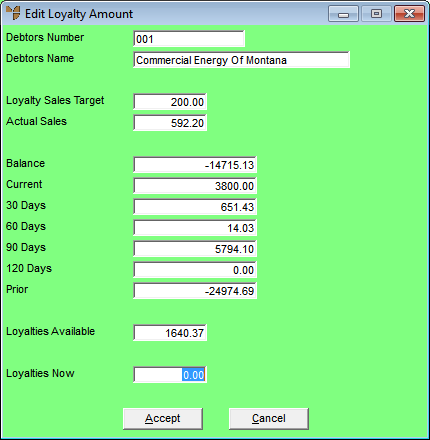

Micronet displays the Edit Loyalty Amount screen.

This screen displays the following information:

|

|

Field

|

Value

|

|

|

Loyalty Sales Target

|

The lowest sales target at which loyalties accrue for this customer.

|

|

|

Actual Sales

|

The customer's actual sales in dollars for the current period.

|

|

|

Balance

|

The debtor's total current account balance, i.e. the sum of all the balances in the following fields.

|

|

|

Current

|

The debtor's account balance (amount owed) for the current period.

|

|

|

30 Days

|

The debtor's 30 day account balance.

|

|

|

60 Days

|

The debtor's 60 day account balance.

|

|

|

90 Days

|

The debtor's 90 day account balance.

|

|

|

120 Days

|

The debtor's 120 day account balance.

|

|

|

Prior

|

The account balance for this debtor prior to 120 days.

|

|

|

Loyalties Available

|

The loyalty credits currently available to the customer for account credit or redemption. This represents the difference between the Loyalties Accrued and Loyalties Redeemed in the Debtor master file.

|

- In the Loyalties Now field, enter the new total value of loyalty credits you want to payout to this customer.

- Select the Accept button.

Micronet redisplays the Payout Debtor Loyalties screen.

- When you are ready to payout the loyalty credits to customers, select the Pay button.

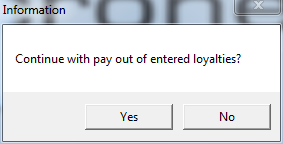

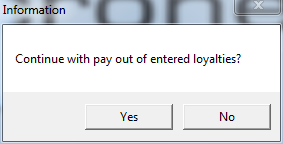

Micronet displays a message asking you to confirm that you want to payout the loyalties.

- Select Yes to payout the loyalty credits.

Micronet pays out the accrued loyalty credits, debiting your bank account, and then redisplays the Payout Debtor Loyalties screen. The information posted is retained in the Debtors Transaction History file for future inquiries and reports.

- Select Cancel to exit the Payout Debtor Loyalties screen.

Micronet redisplays the Debtor Batch - Loyalties screen showing the debtor loyalties batch.

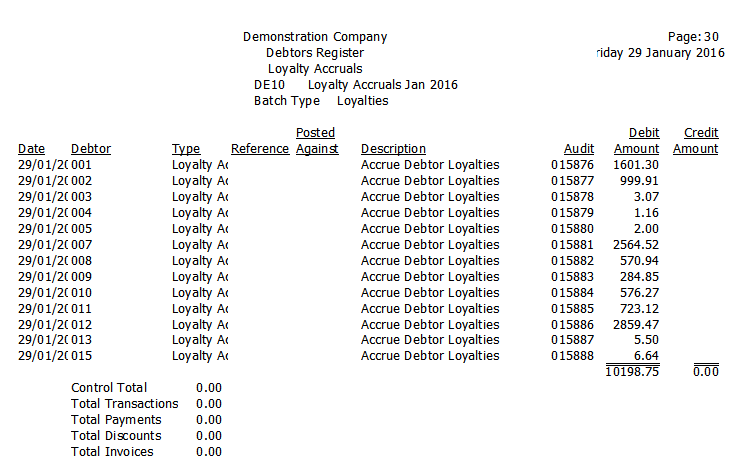

- To print a report showing the details of the loyalty credits paid out in the batch, select the loyalties batch and then:

- select FILE | VERIFY if you want to save the batch so you can print it again

- select FILE | PRINT if you want to print the batch and delete it from the Debtor Batch - Loyalties screen.

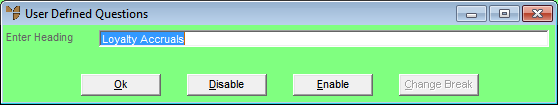

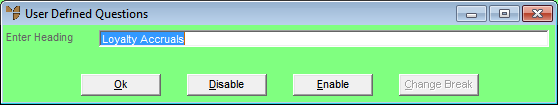

Micronet displays the User Defined Questions screen.

- Enter any heading you want printed on the report then select Ok.

Micronet displays the Select Output Device screen.

- Select whether you want the report displayed on screen, printed, saved to a specific type of file, faxed, or emailed in a specific format.

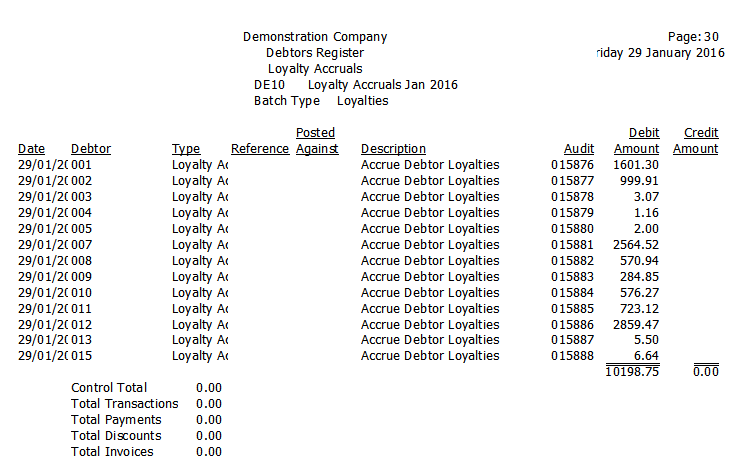

Micronet prints or displays the Debtors Register report.

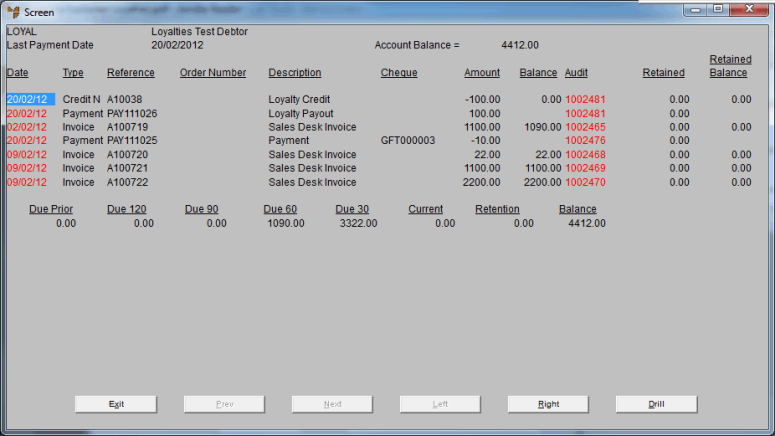

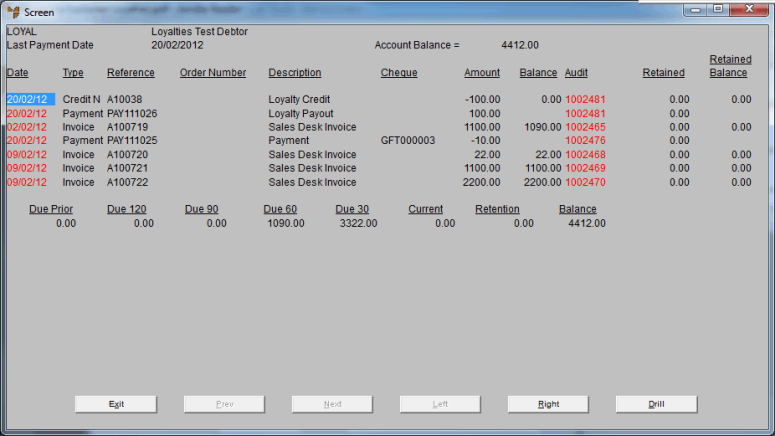

If you do an Account Inquiry on the debtor (see "Inquiry - Account Inquiry"), you can see the loyalty payout transaction and the corresponding reduction in the debtor's loyalty credits: